Each new generation is reared by its predecessor; the latter must therefore improve in order to improve its successor. The movement is circular’ – isn’t it perfectly phrased? Emile Durkheim, the famous French sociologist, knew what he was talking about.

In this article, we will consider the connection between main types of generations in the area of mobile banking adoption.

Generations Theory: why are They Different?

Before turning to the main question, we shall determine the definition of generation theory. Broadly speaking, it is a research approach that describes why different generations emerge, what unites them and how they change.

We will take into account two main categories because they are the most different:

- Generation Y (1981-1995);

- Generation Z and Millennials (1996 and later).

The generational theory justifies many differences between people of different ages. According to this view, present generations have a direct correlation with the state periods of development: rise, sustainability, recession, crisis, then recovery. Mobile banking decisions need to be taken carefully to avoid any loss. The world is not standing still, technologies are changing as well as everyday habits.

However, the concept of historical turns is constant and does not change even if all these factors are met. All periods of technology development affect the values of a given generation. In this regard, different generations access digital banking services differently.

Mobile Banking Technology

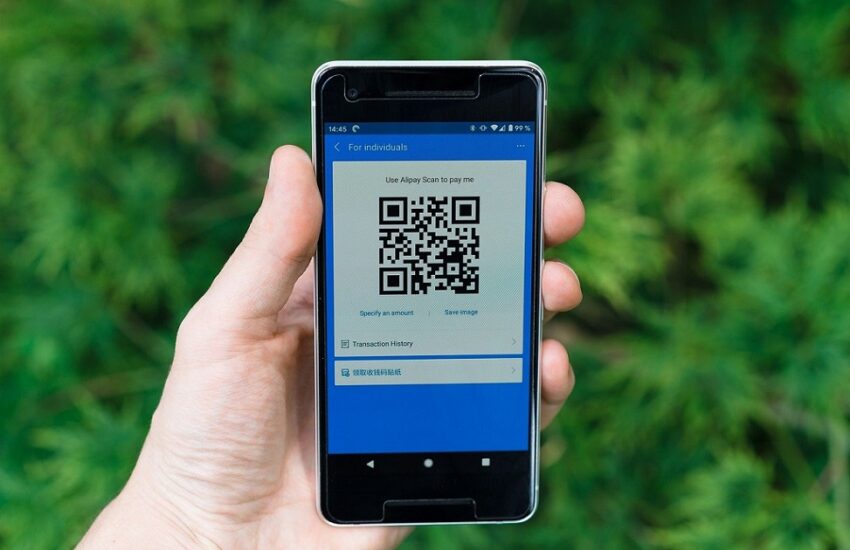

As one of the most innovative technologies, digital banking has spearheaded a new era in the financial industry all around the world. It has gradually become an indispensable banking channel along with ATMs and traditional open banking in the last decade.

Mobile banking unites the following:

- Mobile applications- Fintech apps provide a wide range of functions to meet bank customer needs. They provide 24-hour access to the account’s balance and transaction history. Such apps are designed for all modern financial services, including peer-to-peer payments, international money transfers, wealth and assets management, and more.

- SMS Banking- This technology is used to send push and pull text messages to mobile phones. For example, it enables bank customers to be timely notified about suspicious activity on their bank accounts.

- USSD- Unstructured supplementary service data pre-date the adoption of mobile apps and is still a convenient tool for those who haven’t mobile access. It is often used for checking balances, transferring funds, or getting an expense report.

What do Different Generations Think of Mobile Banking?

The opportunities and threats of the modern world provided Y and Z generations a different approach to technology adoption. Millennials complete numerous tasks with mobile banking apps on a daily basis. Gen Y’s are less likely to use mobile check deposits and transfer money between accounts.

The article in The Financial Brand argued that almost half of the consumers would assume replacing their banking provider with a digital-only one. This implies a younger audience.

Cornerstone Advisors discovered significant changes. As of May 2021, mobile banking adoption has grown to 95% of Gen Zers, 91% of Gen Y’s. But even though Gen Y users are generally still more into attending classic local branches, the current epidemiological situation forced them to slowly change their habits. Clearly, bank clients are getting more and more accustomed to a digital lifestyle.

Notwithstanding the foregoing, there are some differences between mobile banking app consumers’ activities. The Digital Banking Attitudes study by Chase has provided the following insights:

- Generation Y representatives are more likely to create and track a budget, as well as set a savings goal and track their progress. They also check their credit score up to half more frequently compared to the Millennials.

- People from Generation Z are significantly more often into using peer-to-peer payments. They also don’t ask questions in online chat as often as others do.

- The most popular services among both of the consumers’ groups are viewing account statements and balances, and money transfers between bank accounts.

Allison Beer, Head of Digital at Chase, stated the following: ‘The pandemic has demonstrated that digital banking is essential for consumers of all ages to confidently manage their finances.’

Chase’s study also showed 54% of consumers financing agreed they will use digital banking tools more in 2020 compared to the previous year. No doubt, this trend will continue, but there are some milestones on the way.

The Biggest Barrier to Mobile Banking Adoption

Ask a Generation Z representative to attend the bank office for credit card approval – and he’ll hardly ever come back to you because he already found an online service. This differs from the second group of customers. According to the Financial Brand findings, Gen Y representatives were nearly twice as likely (20%) as the Gen Z group (11%) to say an in-person presence is the most important benefit their bank provides.

Studies indicate that perceived risk is one of the most important factors that affect consumers’ intentions towards the adoption of new technology. How is it possible to overcome such a barrier within mobile banking adoption?

Financial institutions can establish trust between digital banking and the elder generation via successful accomplishment and provision of service. They should strive for ethically delivering service with full integrity with no deceiving, and providing a user-centric service with patience.

Conclusion

Today it’s not enough just to know the generation your audience belongs to. More importantly, it’s the historical and social context they were raised in. And banks and Fintech providers need to promote the factors that affect the adoption and use of mobile banking services.

Banks and financial institutions should popularize the benefits of mobile banking such as financial inclusion, easy access to all banking services, and fast payments and transactions. In order to increase the adoption of m-banking services.

Author’s Bio: Alex Kulitski is Founder and CEO of Smart IT and is the co-founder and executive CTO at MEDvidi. Being a serial entrepreneur, he is a keen investor in technology startups and runs several successful side projects besides Smart IT and MEDvidi.